The student loan crisis is very real. Right now student loans total $1.2 trillion and they are growing rapidly.

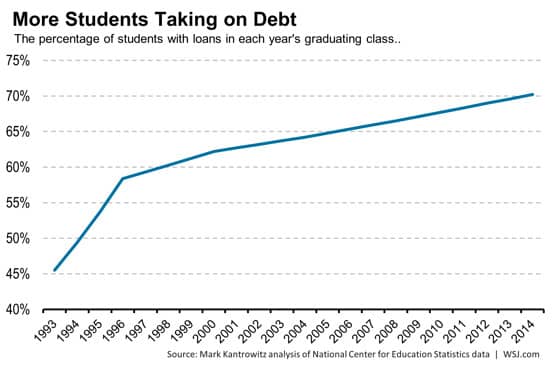

The number of students taking out student loans is steadily increasing. The average student debt for undergraduate degree holders has almost quadrupled since 1992 according to data analysis by student loan expert Mark Kantrowitz.

The average undergrad student will graduate with almost USD 40,000 in student loans. Those who pursued higher degrees or switched majors may be saddled with loans higher than USD 40,000. A survey by the Federal Reserve Board Survey of Consumer Finances showed that almost 19% of student loan holders were up to $50,000 in debt.

Being in debt is stressful. Getting rid of debt is not easy and should not be taken lightly. You need to get a whole plan in place for debt repayment. We shall discuss some strategies to deal with student loans.

Strategy #1: Utilize your grace period to the fullest

Many borrowers have the advantage of a grace period after completing their education. After you finish your education you may get up to six months before you start making payments towards your loan repayment. This is not the period to relax and pursue a “lifestyle”.

Make a game plan for the monthly repayments. If you are holding a good job, start saving the monthly installment fee from day one of your job. If you do not have a good job then save as much as possible and start an aggressive job hunt. Put your ego aside and contact everyone who could help, from classmates to professors. You should also approach professional head-hunters.

You have to understand your loans

Most people take out multiple loans over the course of their education. Each loan comes attached with its own varying conditions, for example, different minimum monthly payments.

Find out what has to be paid towards which loan and which loans would qualify for things like deferment, loan forgiveness, and a better payment plan.

Strategy #2: Consolidate or Refinance your Loans

As discussed above, most people have a number of student loans. All of them will have varying interest rates. Consolidation means that you combine all your loans into one single loan with a low interest rate.

Consolidations will also allow you to lower your monthly payment and extend your repayment period (also called term) for up to 30 years! However, remember lower monthly payments and an extended term may lead you to paying more in total. Federal student loan consolidation is also an option which can be opted.

When consolidating you may also get the option of changing your interest rate from variable to a fixed interest rate. However, when going for consolidation you risk losing benefits like loan cancellation benefits, principal rebates, or interest rate discounts.

Strategy #3: Refinance

Student loan refinancing is defined as:

“When a loan holder pays off the existing loan in order to establish a new loan, usually with lower interest rates”

If you have a steady income stream and are willing to pay off loans earlier then refinancing is a good option for you.

Refinancing will usually get you a lower interest rate. This is ideal if you have just started paying off your loan. Even later on in the loan refinancing is a good option for those who are looking to extend the term. However, extending the term means more money paid towards the loan in total.

However, remember, if you refinance federal loans you lose the advantages that come with them.

Strategy #3: Sign up for auto-debt

Many people ignore this gold nugget. Often signing up for auto-debit gets you a discount on the interest rate. Even if it does not, it does eliminate the chance of missing a payment and incurring penalty fees.

Enrolling in auto-debit is a convenient way to make payments as you could receive a percentage point interest rate reduction on your eligible loan(s). It would also ensure that your payments are made on time as payments would get deducted automatically from the current amount due from the designated band account on the current amount due date as per the agreed terms from the bank.

Strategy #4: Enroll yourself in a qualifying payment plan

Income-based payments is the best payment plan for many borrowers as it sets a low monthly payment based on your income, it furthers allows you to make progress toward on-time qualifying payments and loan forgiveness.

Strategy #5: Negotiate your salary

You can always ask for raise, some extra working hours or bonuses to pay your student loan debt. Negotiate some extra working hours or additional projects that you can work on to earn more than your regular salary. This would help to pay off your student loan and ease some pressure on you.

Once you pay off your debt through such strategies, a whole new world of opportunities will open up for you and eventually, your hard work will pay off in the end.